The approval marks a major compliance milestone for Watsans Exchange, reinforcing its commitment to transparency, regulatory excellence, and global expansion.

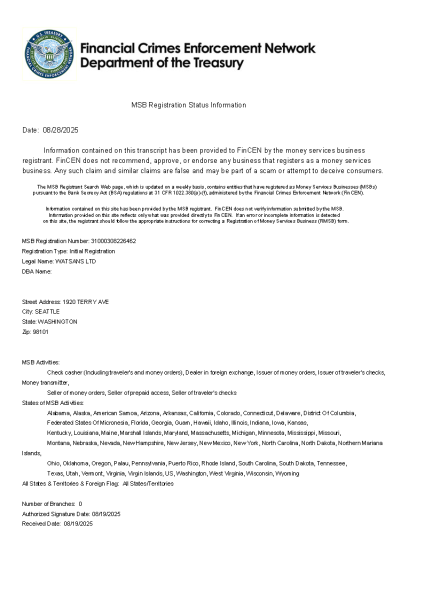

Global digital asset platform Watsans Exchange has officially announced that it has been granted a Money Services Business (MSB) license by the Financial Crimes Enforcement Network (FinCEN), a bureau under the U.S. Department of the Treasury. This achievement represents a critical milestone in Watsans Exchange’s ongoing pursuit of compliance and responsible innovation, solidifying its position as a trusted leader in the international digital finance sector.

A Globally Recognized Regulatory Milestone

The MSB license is one of the most important legal authorizations required for operating money transmission, currency exchange, and digital asset services in the United States. Under FinCEN regulations, licensed institutions must strictly adhere to Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) standards, maintain comprehensive Know Your Customer (KYC) procedures, and implement robust transaction monitoring and risk management systems.

Watsans Exchange’s approval reflects its strong capabilities in compliance governance, risk control, and technological security, paving the way for further expansion into the U.S. and other global markets.

To ensure full transparency, users can verify Watsans Exchange’s registration status and license details through the official FinCEN MSB Registration Portal by searching the company name. If the system is under maintenance or delayed, users are advised to try again later or contact customer support for assistance.

Laying the Groundwork for Global Growth

Watsans Exchange currently serves users across more than 100 countries and regions worldwide. The platform continues to prioritize technology-driven innovation and safety, focusing on key areas such as cryptographic security, data privacy protection, and AI-powered trading systems.

Obtaining the MSB license signifies not only a breakthrough in global regulatory compliance but also confirms that Watsans Exchange’s operational framework meets the highest standards recognized by mainstream financial markets. The company will continue to enhance its internal compliance structure, improve transparency, and contribute to the sustainable development of the digital asset ecosystem.

Commitment to Compliance and Innovation

As global crypto-asset regulations evolve, Watsans Exchange remains firmly committed to the principles of security, transparency, compliance, and innovation. The company will actively align with international regulatory standards, strengthen global partnerships, and expand its service infrastructure to create a more open and trusted financial environment.

This milestone underscores Watsans Exchange’s long-term dedication to responsible growth and highlights its leadership as a next-generation provider of digital financial infrastructure.

About Watsans Exchange

Watsans Exchange is a global fintech platform focused on digital asset trading and financial innovation. The company provides secure, efficient, and compliant trading services through advanced security architecture and intelligent algorithms. With continuous technological development and an expanding international footprint, Watsans Exchange is building a secure bridge that connects global users to the future of digital finance.

Media Contact

Organization: Watsans

Contact Person: Mark Sullivan

Website: https://watsans.com/

Email: Send Email

Country:United States

Release id:36609

The post Watsans Exchange Secures U.S. Money Services Business (MSB) License appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Economy Extra journalist was involved in the writing and production of this article.