The Stock-market is rehashing an example of midmonth staggers a few experts bind to alternatives termination. That dynamic could be intensified for this present week in front of “quadruple witching,” the concurrent termination Friday of individual investment opportunities, stock-record choices, stock-list fates and single-stock fates.

Alternatives are monetary instruments that give the holder the right yet not the commitment to purchase, on account of a call choice, or sell, on account of a put choice, the fundamental resource at a set cost by a specific time.

“Almost like clockwork, over the past six months the S&P 500 has fallen in the week leading into OpEx, so the risk is we see this flow repeat and come into play this week, which could mean weakness into Friday’s expiry — although perhaps it’s all too obvious now,” said Chris Weston, head of exploration at Pepperstone, in a Monday note. OpEx is dealer shoptalk for alternatives lapse.

One famous clarification of the dynamic requires momentarily deciphering a few alternatives language: Delta estimates how much a choices cost is relied upon to change for ever $1 move in the cost of the hidden resource. Gamma estimates the speed of the adjustment of an alternatives delta.

The Friday termination “should get some focus because the talk is market makers are long gamma, and this has had the effect of reducing volatility,” Weston composed. Successfully, market creators who have sold choices are taking situations in the fundamental stocks or different instruments to support their market openness.

“When this gamma rolls off the market, it typically means the index is free to move as it should, as market makers have less position risk to hedge,” Weston said.

Bloomberg recently noted episodes of market shortcoming in front of the lapse of month to month investment opportunities, which happens on the third Friday of the agreement month. The report saw that a few investigators had tied episodes of shortcoming across value markets in the not so distant future of the month to month alternatives lapses in February, April, June, July and August.

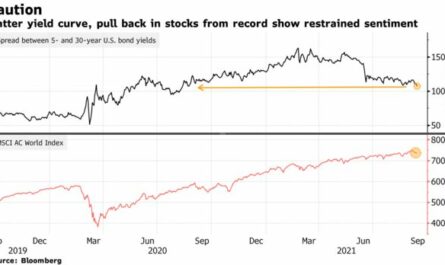

Heading into Friday’s fourfold witching — a union that happens once every quarter and is normally connected with the potential for expanded instability and high exchanging volume — stocks were staggering once more. The S&P 500 SPX, – 0.57% fell 0.6% on Tuesday, leaving the enormous cap benchmark down almost 2% in the month to date. The S&P 500 has fallen in six of the last seven meetings, while the Dow Jones Industrial Average DJIA, – 0.84% has declined in nine of the beyond 11 meetings.

Fourfold witching can make for uneven exchanging in light of the fact that “so many things are coming off at once, and firms unwinding positions versus each other and versus their stocks,” said J.J. Kinahan, boss market tactician at TD Ameritrade, in a telephone meet.

That action, joined with an absence of crisp exchanging impetuses, could keep on making for rough value activity in coming meetings, he said.

While there was some prompt response to a milder than-anticipated expansion report Tuesday, the information didn’t fundamentally change market assumptions. A gathering of Federal Reserve strategy creators likewise shows up improbable to change business as usual, and keeping in mind that a sprinkling of organizations are presenting results, the market is viably in a profit quiet before second from last quarter detailing season gets going one month from now, he said.

Kinahan, nonetheless, was less persuaded that month to month alternatives terminations has been a huge market driver lately. While the quarterly fourfold witching occasion is outstanding, the notoriety of week by week alternatives might have dulled the effect of month to month lapses to some degree, he said.

The Cboe Volatility Index VIX, – 2.72%, a proportion of expected instability in the S&P 500 over the coming 30 days, has battled to break over its drawn out normal almost 20. In any case, the check can probably remain in a reach somewhere in the range of 16 and 20 for quite a while, Kinahan said.

“Back-and-forth choppiness won’t end fully until we have a clearer picture on what the Fed is doing in terms of timing” with regards to downsizing its improvement endeavors, he said.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Economy Extra journalist was involved in the writing and production of this article.