Most Asian stocks fell Wednesday while Treasuries held increases in the midst of worries about a more slow recuperation from the pandemic just as the effect of raised cost pressures on the worldwide economy.

Offers withdrew in Japan and Hong Kong and vacillated in China, where the economy debilitated on strides to control a Covid-19 episode. Macau club stocks slid on strides to help oversight, the most recent heightening in Beijing’s administrative upgrade. U.S. prospects faltered after decreases in the S&P 500 and Nasdaq 100.

Chinese information showed a sharp log jam in retail deals development as infection checks hit customer spending and travel during the pinnacle summer occasion break. The figures will take care of into tension that the world monetary recuperation has topped.

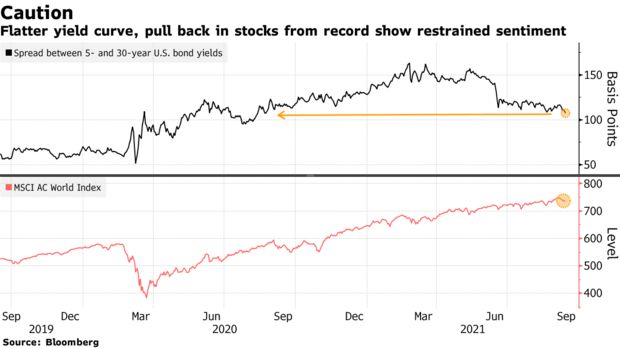

The 10-year U.S. Depository yield held a fall underneath 1.30%. U.S. expansion was not as much as gauge in August while staying raised, leaving the contention concerning whether costs pressures are transient unsettled. The dollar was consistent.

While the expansion print could be viewed as facilitating tension on the Fed to begin pulling back on free financial arrangement, financial backers stay careful about the effect of the delta infection variation and increasing expenses on monetary returning. Sovereign obligation in Australia and New Zealand climbed following the convention in Treasuries.

“It is hard to argue at this point that it remains entirely transitory,” Dana D’Auria, Envestnet Inc. co-chief investment officer, said on Bloomberg Television, referring to U.S inflation. “You couple that with that fact that there are still all these supply shocks that we are still working through. I think the markets are going to have to feel the pain.”

Going into the year-end, financial backers will likewise need to process banter around the U.S. obligation roof, President Joe Biden’s duty bundle, framework spending and Fed tightening, she added.

Somewhere else, oil acquired after a U.S. industry report showed a drop in inventories of rough and gas. Gold held a trip.

Here are a few occasions to watch this week:

Fourfold witching day for U.S. markets, Friday

For more market examination, read our MLIV blog.

A portion of the primary moves in business sectors:

Stocks

S&P 500 fates rose 0.1% as of 12:06 p.m. in Tokyo. The S&P 500 fell 0.6%

Nasdaq 100 fates added 0.1%. The Nasdaq 100 fell 0.3%

Japan’s Topix list fell 1%

Australia’s S&P/ASX 200 Index dropped 0.4%

South Korea’s Kospi list expanded 0.3%

Hong Kong’s Hang Seng Index fell 0.7%

China’s Shanghai Composite Index was consistent

Currencies

The Japanese yen exchanged at 109.63 per dollar, up 0.1%

The seaward yuan was at 6.4411 per dollar

The Bloomberg Dollar Spot Index was minimal changed

The euro was at $1.1806

Bonds

The yield on 10-year Treasuries rose around one premise highlight 1.29%

Australia’s 10-year security yield fell four premise focuses to 1.21%

Commodities

West Texas Intermediate rough was at $70.93 a barrel, up 0.7%

Gold was at $1,802.60 an ounce, down 0.1%

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Economy Extra journalist was involved in the writing and production of this article.